Spring Statement 2024: The Key Points

The heat is really on for Chancellor Jeremy Hunt and the Conservative party. Today’s Spring Budget is setting out the government’s plans for tax and spending over the coming year.

Rumours and pre-budget predictions have seen a call for re-election, giving the conservative party chance to guage public reaction to some of their decisions. Let’s see if they meet the British public in delivering some popular and widely understood decisions, or whether the NHS cuts are true; in spite of current spending on war.

We will address the key events in today’s Spring Budget and announcements and see what they mean for the British consumer.

…Mr Hunt addresses loss of life in Gaza and offers £1million to be given to create a memorial for Muslim life lost in World Wars.

… Promises of long- term growth plan

But it is also because “lower taxes mean higher growth”.

He says higher growth cannot come from more immigration.

Inflation

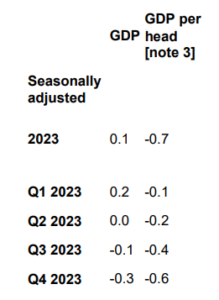

“figures show that forcasts from OBR have forecast it was 11% when he and Rishi Sunak took office.

The latest figures show it at 4%, and the OBR forecasts show it falling below the 2% target in just a few months time – a year earlier than forecast in the autumn statement.

Debt Support

Abolition of £90 charge for a debt relief order

For people taking advance loans, he will increase the repayment programme from 12 months to 24 months, he says.

For some people a debt relief order will help. But they got £90, he says. He will abolish that charge.

Duty Freeze

Alcohol Duty Freeze Extended

Fuel

Hunt claims that “if I did nothing fuel duty would raise by 13%” by not doing this and offering a freeze he is claiming action but is in fact doing nothing.

Julie Daniels, motor insurance expert at Compare the Market, comments: “Motorists will be relieved that the Chancellor has chosen to freeze fuel duty. However, the cost of driving is still increasing, and some motorists are finding it difficult to stay on the road. Compare the Market’s figures show a typical motor premium has increased by £279 in February year-on-year to reach £892. With the cost of running a car becoming more expensive, many drivers have been forced to make fewer journeys or are cutting back on seeing friends and family. Worryingly, some expect to take on further debt to keep driving. With car insurance pushing up the cost of driving significantly, it’s important for motorists to compare prices online ahead of renewal as there could be hundreds of pounds to be saved. It’s also worthwhile for people to consider if they’re able to encourage or support friends and family members to look for savings online.”

VAT Changes

Tens of thousands of businesses will not need to pay VAT from April.

VAT registration threshold will increase from £85,000 to £95,000. Mr Hunt says that this is the first increase in seven years.

New British ISA

And the government will introduce a new “British ISA”, allowing investments of £5,000 in British firms. This ISA allowance will be on top of the existing one.

It’s focus will be only on UK assets. Michael Summergill chief executive of AJ Bell say that The new British ISA is doomed to fail in those objectives – UK retail investors are already putting 50% of their ISA investments into UK assets so the additional allowance will not change investor behaviour” they go on to say that “The aim is laudable, but the British ISA is simply the wrong way to achieve it. If the aim is to boost investment in UK companies, the answer lies elsewhere. For example, extending the existing AIM exemption from stamp duty and/or inheritance tax to a wider pool of UK assets would actually have a meaningful impact.”

NHS Productivity

Government claim they will slash the 13m hours lost by doctors and nurses every year to outdated IT systems. “AI will be used to cut down form filling and operating theatre processes will be digitised”

He claims that antiquated systmems delay care before adding “I wanted better care for patients, better value for taxpayers and more rewarding work for its staff. Making changes on the scale we need is not cheap. The investment needed to modernise NHS IT systems so they are as good as the best in the world costs £3.4 billion.

“But it helps unlock £35 billion of savings, 10 times that amount. So in today’s Budget for long-term growth, I have decided to fund the NHS productivity plan in full.”

He added: “We will slash the 13 million hours lost by doctors and nurses every year to outdated IT systems. We will use AI to cut down and potentially cut in half form filling by doctors. We will digitise operating theatre processes allowing the same number of consultants to do an extra 200,000 operations a year.

Child Benefit

Mr Hunt announces an increase in the threshold at which parents start paying the High Income Child Benefit Charge, from £50,000 to £60,000. Making almost half a million families better off by an average of almost £1300 per household.

Taxes

New tax on vapes.

Tax relief on holiday lettings unfrozen to improve availability for long term letting.

Windfall tax extended for energy companies.

Income Tax Cut by 2p

From April 6 NI will be cut by 2p. From 10% to 8% and self-employed NICS from 8% to 6%.

Hunt claims, combined with the changes announced in the autumn statement, 27 million people will gain £900. And 2 million self-employed people will gain £650, the lowest tax since 1975 (Editor‘s note: in spite of a totally different taxation system in 1975 and VAT not even existing yet).

He says the OBR says this will put 200,000 more people in work. And it will increase GDP by 0.4%, he says.

Turn2Us comment:

“The reduction in National Insurance will not benefit those on the lowest incomes. What we need is a comprehensive overhaul of the relationship between our welfare system and its beneficiaries. Such reform should begin with adjusting benefits to adequately cover essential living costs and abolishing punitive, ineffective measures like the two-child limit and sanctions.”

The post Spring Statement 2024: The Key Points appeared first on MoneyMagpie.

Labels: News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home