Your Old Spice Girls Merch Could Be Worth Hundreds Today – Check Your Loft

Experts Tell Us Your Old Spice Girls Merch Could Be Worth a Fortune Today – Here’s What to Look For

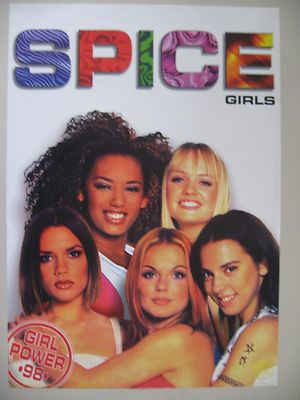

If you grew up in the 1990s, there’s a good chance your childhood bedroom once looked like a shrine to the Spice Girls. Posters on the wall, dolls on the shelf, maybe even a pencil case proudly declaring Girl Power.

At the time it was just fun fandom. But today? Some of that merchandise is quietly becoming serious collectors’ gold.

As the Spice Girls approach the 30-year anniversary of their debut single Wannabe in 2026, nostalgia is booming — and collectors are willing to pay surprising amounts for rare memorabilia. That means items tucked away in lofts, cupboards, or old toy boxes could now be worth hundreds (sometimes even thousands) of pounds.

So before you donate that old merch to a charity shop, it might be worth taking a closer look.

Here are some of the most valuable Spice Girls collectibles — and how to tell if yours could be worth money.

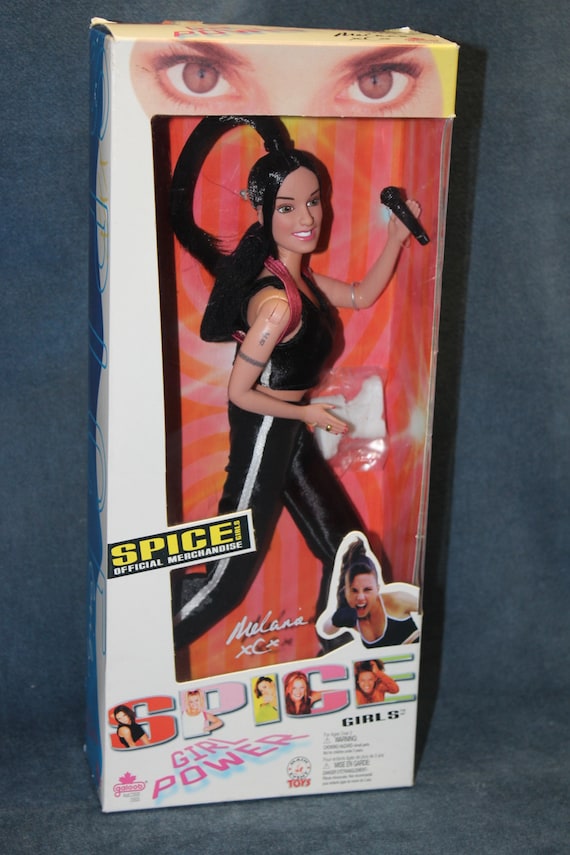

Spice Girls Dolls (Especially the Original 1997 Set)

The official Spice Girls dolls released in 1997 by Galoob were everywhere at the height of Spice Mania. But complete sets in good condition are now surprisingly collectible.

What makes them valuable:

- Original packaging (very important)

- Full five-doll sets

- Limited editions or tour versions

- Dolls that still include accessories like microphones or outfits

Typical value

Typical value

- Individual dolls: £20–£60

- Full boxed sets: £150–£300+

- Rare editions: up to £500

Many collectors specifically look for complete boxed sets of all five Spice Girls, so if yours are still in their packaging, you may have struck gold.

Spice Girls Polaroid Camera

One of the most iconic — and slightly quirky — pieces of merchandise was the Spice Girls Polaroid instant camera.

These were hugely popular in the late 90s, but many were heavily used and eventually thrown away. Working models in good condition are now sought-after nostalgia items.

Collectors particularly value:

- Cameras with the original box

- Models that still work

- Bundles with accessories or film packs

Typical value

Typical value

- Used camera: £40–£100

- Boxed collectible: £150+

Spice Girls Tour Merchandise

Vintage concert merchandise is one of the fastest-growing collectible categories — and Spice Girls tour items are no exception.

T-shirts from the 1997–1998 Spiceworld tours are especially valuable, particularly if they feature the original lineup.

Collectors love:

- Tour T-shirts

- Backstage passes

- Tour programmes

- Limited-edition venue merchandise

Typical value

Typical value

- Tour T-shirts: £40–£120

- Rare programmes or memorabilia: £100+

Condition matters a lot here — items that haven’t faded or cracked with age tend to sell for much more.

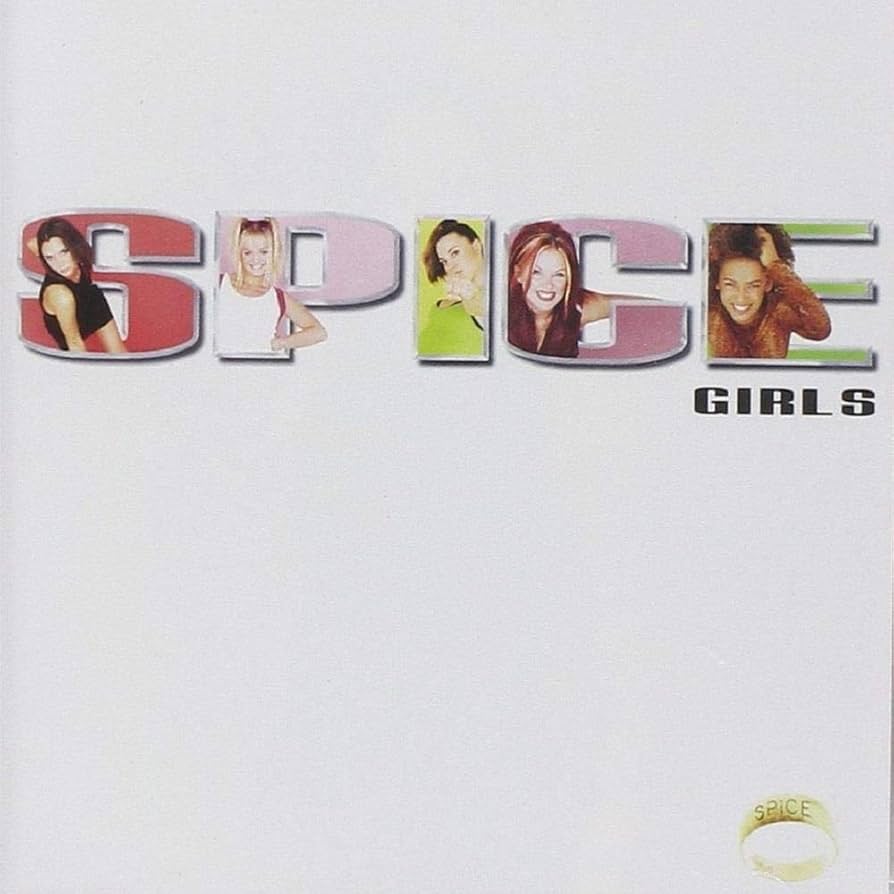

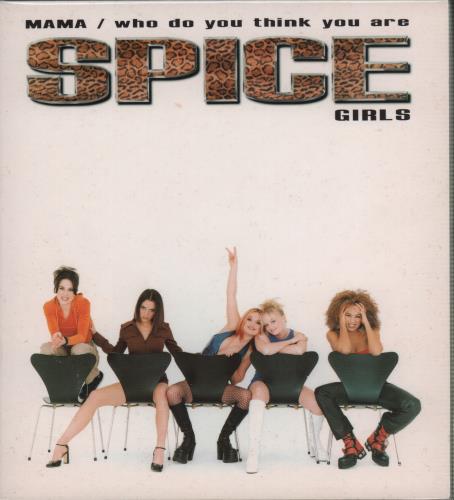

Spice Girls Albums, Singles and Vinyl

Music collectors are increasingly looking for original vinyl pressings and limited-edition singles.

Particularly desirable items include:

- Original pressings of “Wannabe”

- Picture disc vinyl releases

- Signed albums

- Promotional releases sent to radio stations

Typical value

Typical value

- Standard vinyl: £20–£50

- Limited editions: £100+

- Signed copies: £300+

Rare Promotional Items

Some of the most valuable Spice Girls memorabilia was never sold in shops at all.

Promotional items given away through competitions or brand collaborations can fetch big money today.

Examples include:

- Pepsi promotional merchandise

- Fan club exclusives

- Limited-edition posters

- Retail display items used in record shops

Typical value

Typical value

Anywhere from £50 to several hundred pounds, depending on rarity.

Spice Girls Pepsi Cans and Bottles

In 1997, the Spice Girls teamed up with Pepsi in one of the biggest pop promotions of the decade.

Limited-edition Pepsi cans and bottles featuring the band were released across the UK and quickly became collectibles.

While many were thrown away, complete sets can now sell surprisingly well.

Typical value

Typical value

- Single cans: £10–£30

- Full sets: £50–£150+

Collectors often look for unopened cans or display sets, which are much harder to find.

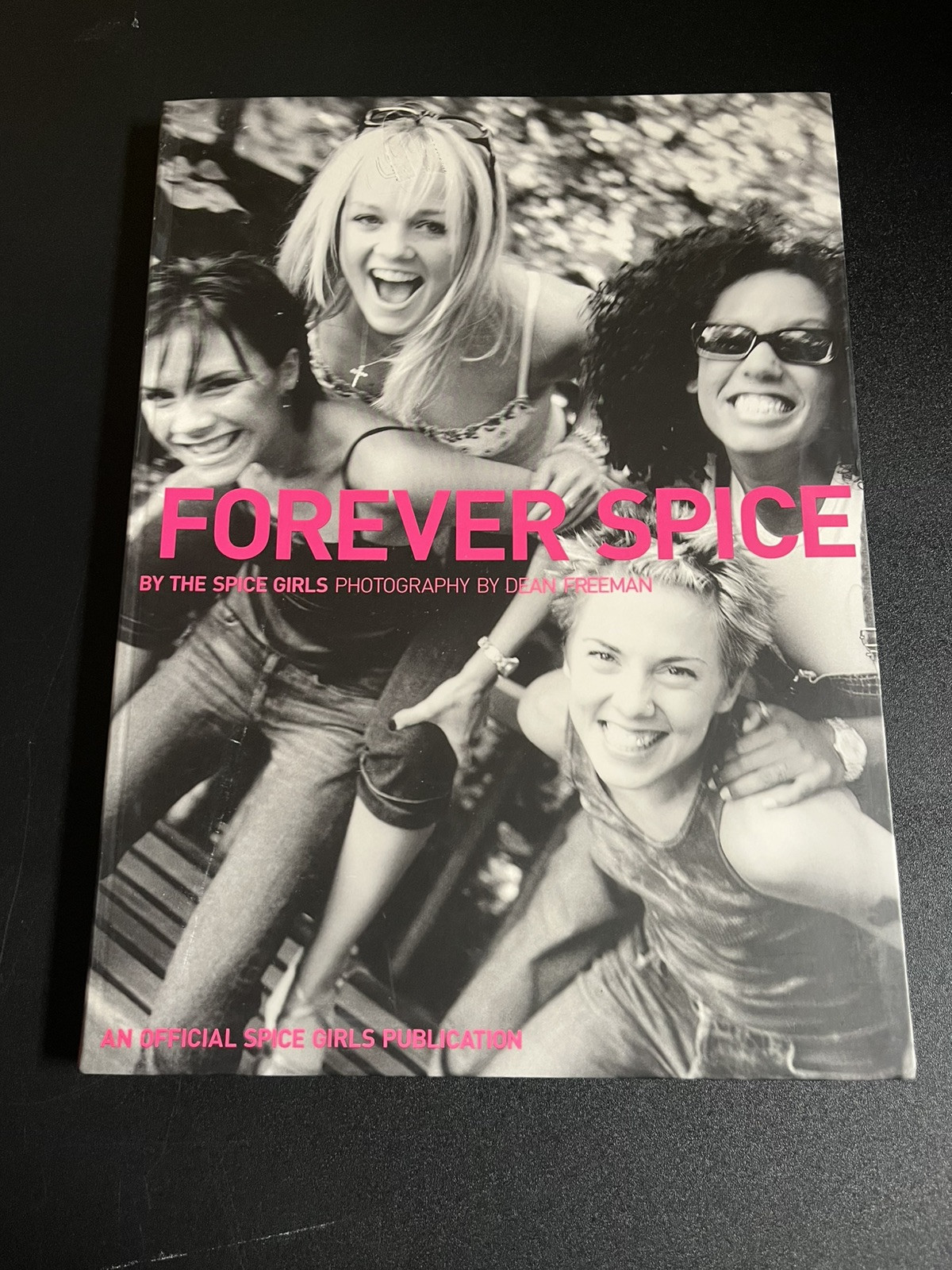

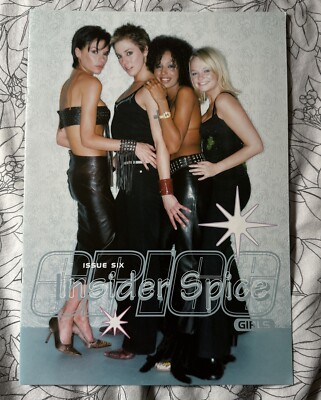

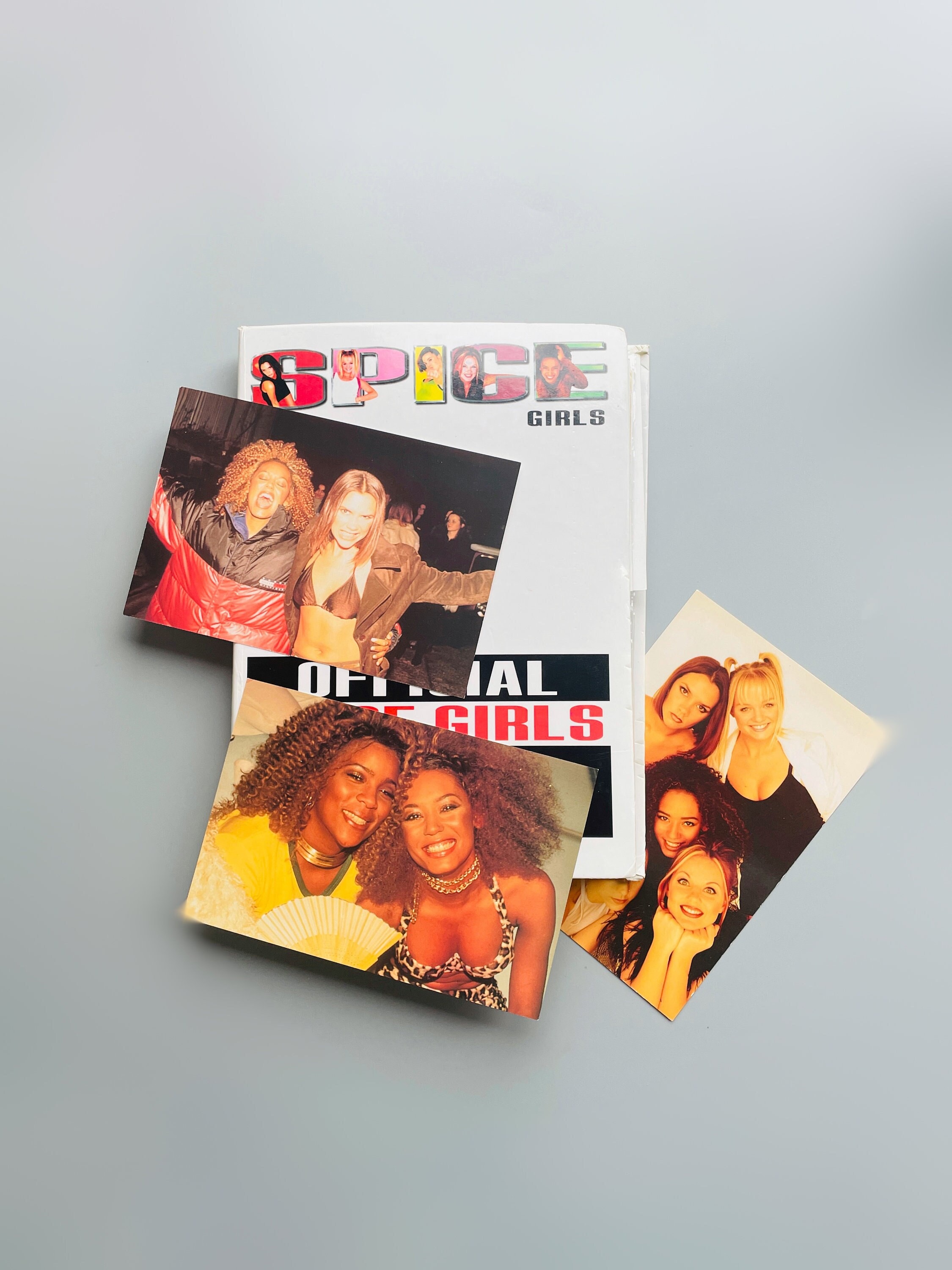

Spice Girls Magazines and Annuals

In the late 90s, the Spice Girls were everywhere — including magazine covers, annuals and fan club publications.

Some of these are now collectible, particularly:

- Early Smash Hits covers

- Official Spice Girls annuals

- Rare fan club magazines

- First-edition tour programmes

Typical value

Typical value

- Annuals: £15–£40

- Rare magazines: £30–£80+

Complete collections or issues in excellent condition can fetch more.

How to Check If Your Spice Girls Merch Is Valuable

Before listing anything online, take a moment to check a few key things:

Look for the year

Most valuable items date from 1996–1999, the height of Spice Mania.

Check eBay sold listings

Search for your item and filter by “Sold Items” to see real selling prices.

Keep original packaging

Boxes, tags and certificates dramatically increase value.

Don’t clean aggressively

Collectors often prefer items in original condition, even with light wear.

10 Spice Girls Items People Still Have at Home (That Could Be Worth Money)

If you were a Spice Girls fan in the late 90s, chances are you owned at least one of these. Many were everyday items at the time — lunchboxes, magazines, posters — but some have quietly become collectors’ pieces as 90s nostalgia surges.

Before clearing out the loft or donating childhood belongings, it might be worth checking if any of these are hiding in old boxes.

Spice Girls Lunchboxes and School Bags

School accessories were some of the most popular Spice Girls merchandise during the height of Spice Mania.

While many were heavily used, items in good condition are now becoming collectible — especially the colourful metal lunchboxes and backpacks featuring the band.

Typical value

Typical value

- Lunchboxes: £20–£60

- School bags: £25–£80

Unused items or those with minimal wear can sell for more.

Spice Girls Posters and Wall Art

In the late 90s, Spice Girls posters covered bedroom walls across the UK.

While most are still common, large promotional posters from record shops or early tour posters can attract collectors.

Typical value

Typical value

- Standard posters: £10–£30

- Rare promotional posters: £50–£150+

Posters that have never been folded tend to be the most valuable.

Spice Girls CD Singles and Box Sets

Before streaming, fans often bought multiple CD singles — sometimes with different cover artwork or bonus tracks.

Collectors today are particularly interested in:

- Limited-edition box sets

- Early UK CD singles

- Promotional releases

Typical value

Typical value

- Standard CDs: £5–£20

- Box sets or limited editions: £40–£120+

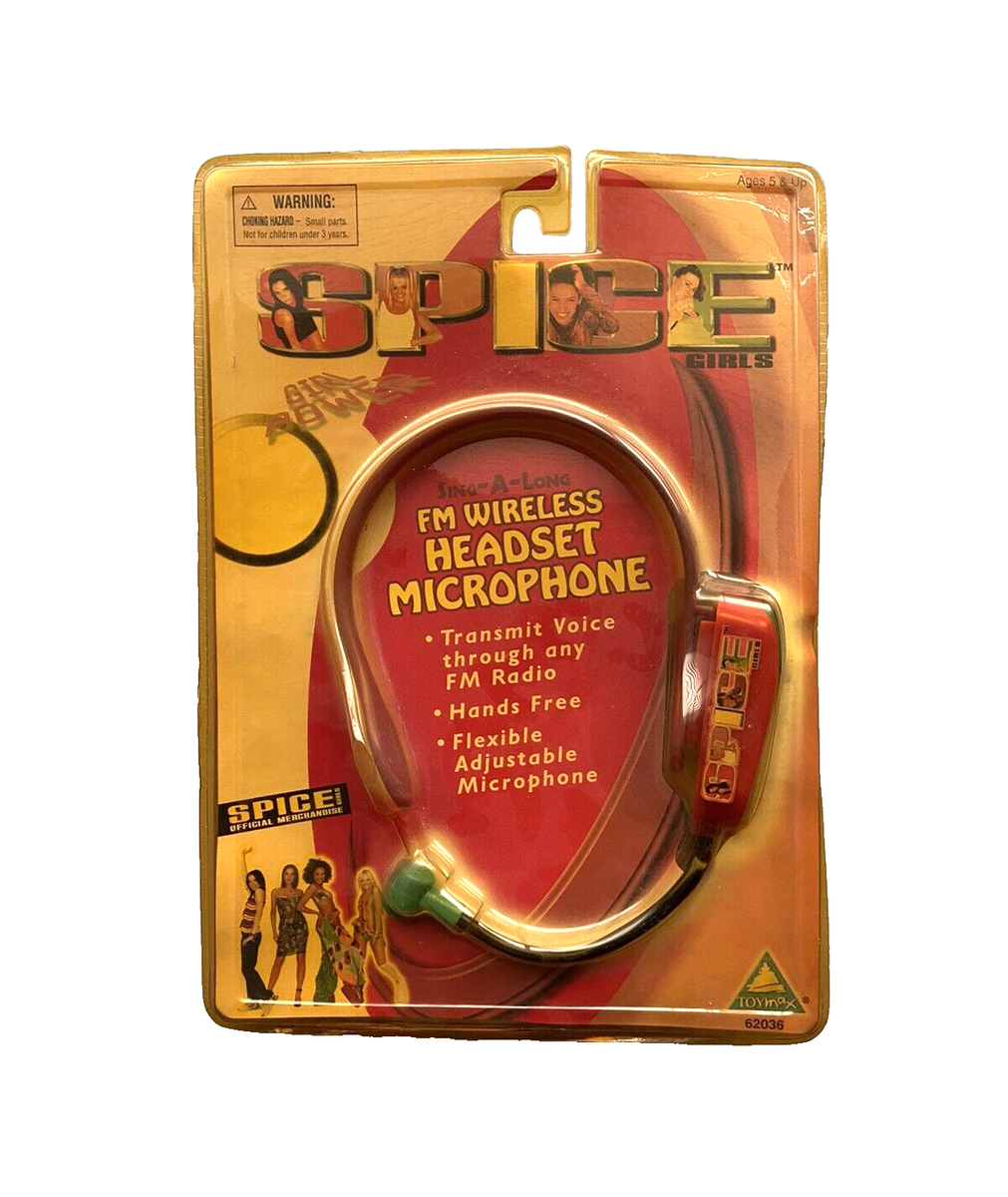

Spice Girls Board Games and Toys

Like many huge pop acts of the time, the Spice Girls appeared on board games, trivia sets and toy microphones.

Many of these were opened and played with, so complete boxed versions are now far harder to find.

Typical value

Typical value

- Games: £20–£50

- Rare or sealed items: £80+

Collectors often pay more if the game still includes all the original pieces and instructions.

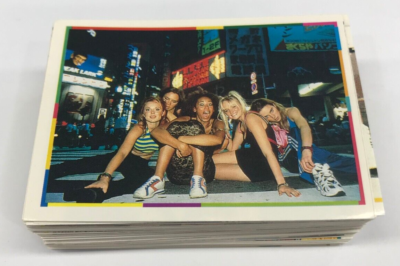

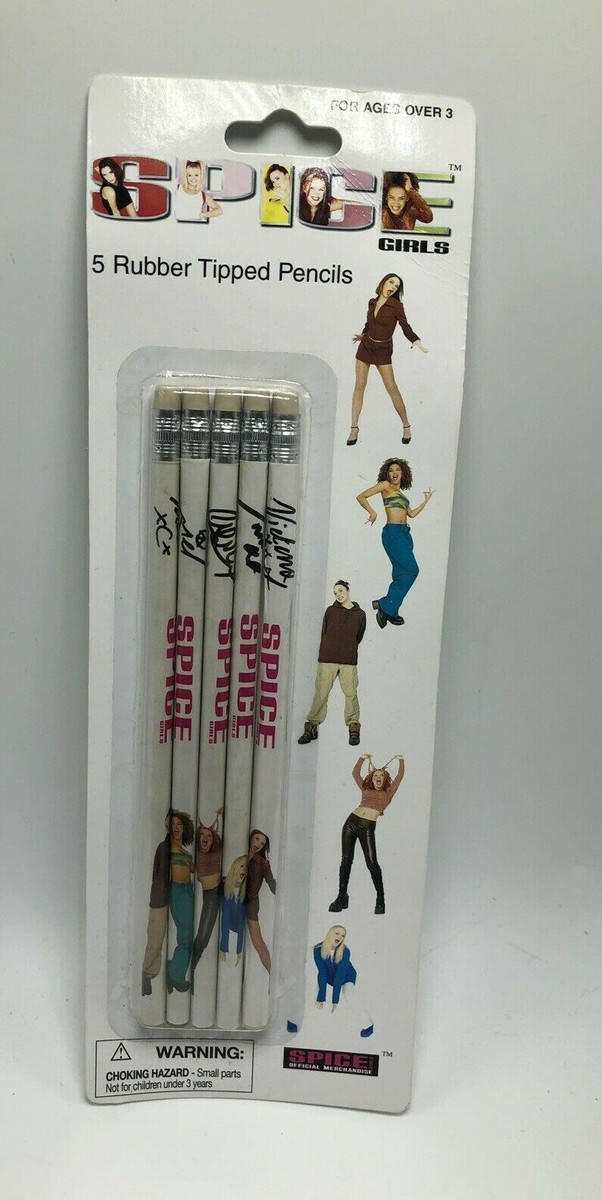

Spice Girls Stickers, Trading Cards and Stationery

Sticker albums and trading cards were hugely popular during the 90s, and the Spice Girls were no exception.

The most collectible items include:

- Completed sticker albums

- Rare trading card sets

- Unused stationery packs

Typical value

Typical value

- Sticker albums: £20–£60

- Complete trading card sets: £40–£100+

Again, condition matters — unused or sealed items are always more desirable.

Why Spice Girls Nostalgia Is Booming

With the band approaching three decades since their debut, the Spice Girls remain one of the most iconic pop acts in British music history.

For many millennials, their merchandise represents pure childhood nostalgia, which is exactly why collectors are now hunting down original items.

And as fewer survive in good condition, the value of certain pieces has quietly started climbing.

So if you were once proudly shouting Girl Power! while clutching a Spice Girls lunchbox or doll, it might be time to check the loft.

That childhood memorabilia could now be worth more than you ever expected.

Where to Sell Spice Girls Collectibles

If you discover something valuable, these platforms are popular with collectors:

- eBay – biggest audience for nostalgic memorabilia

- Vinted – growing vintage market

- Facebook collector groups

- Specialist music memorabilia auction sites

Timing can also make a difference. Prices often spike around anniversaries, reunions or documentaries, when nostalgia surges.

The Bottom Line

For many of us, Spice Girls merchandise is more than just memorabilia — it’s a slice of childhood.

But with 90s nostalgia booming and collectors hunting rare items, that old merch box could be hiding something surprisingly valuable.

So if you once shouted “Girl Power!” into a plastic microphone or dressed your dolls like Baby Spice, it might be worth digging through the attic.

You never know — your old fandom could now be worth a tidy little payday.

The post Your Old Spice Girls Merch Could Be Worth Hundreds Today – Check Your Loft appeared first on MoneyMagpie.

Labels: News

2026 Collector Trend Scorecard — Online Buzz + Investment Signals

2026 Collector Trend Scorecard — Online Buzz + Investment Signals

Key Takeaways for 2026 Collectors & Investors

Key Takeaways for 2026 Collectors & Investors